carried interest tax proposal

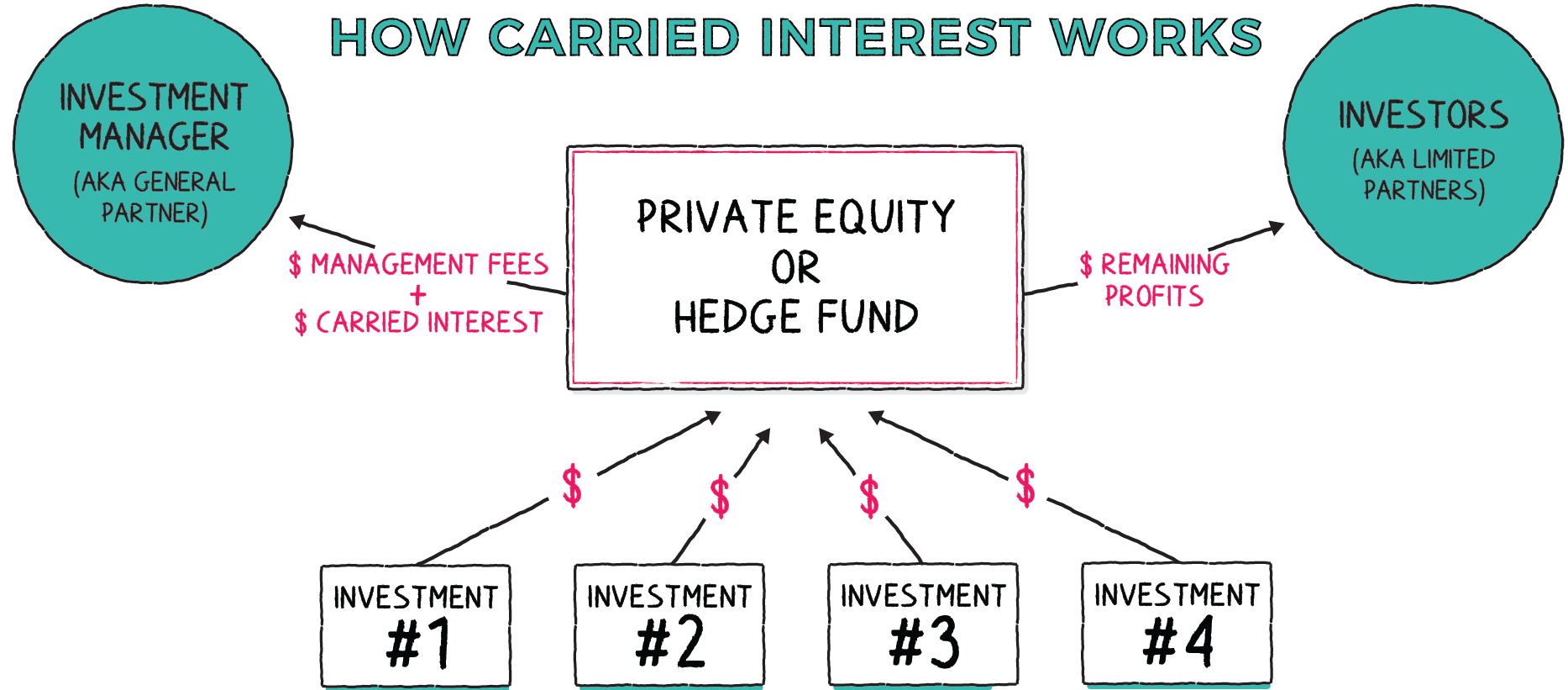

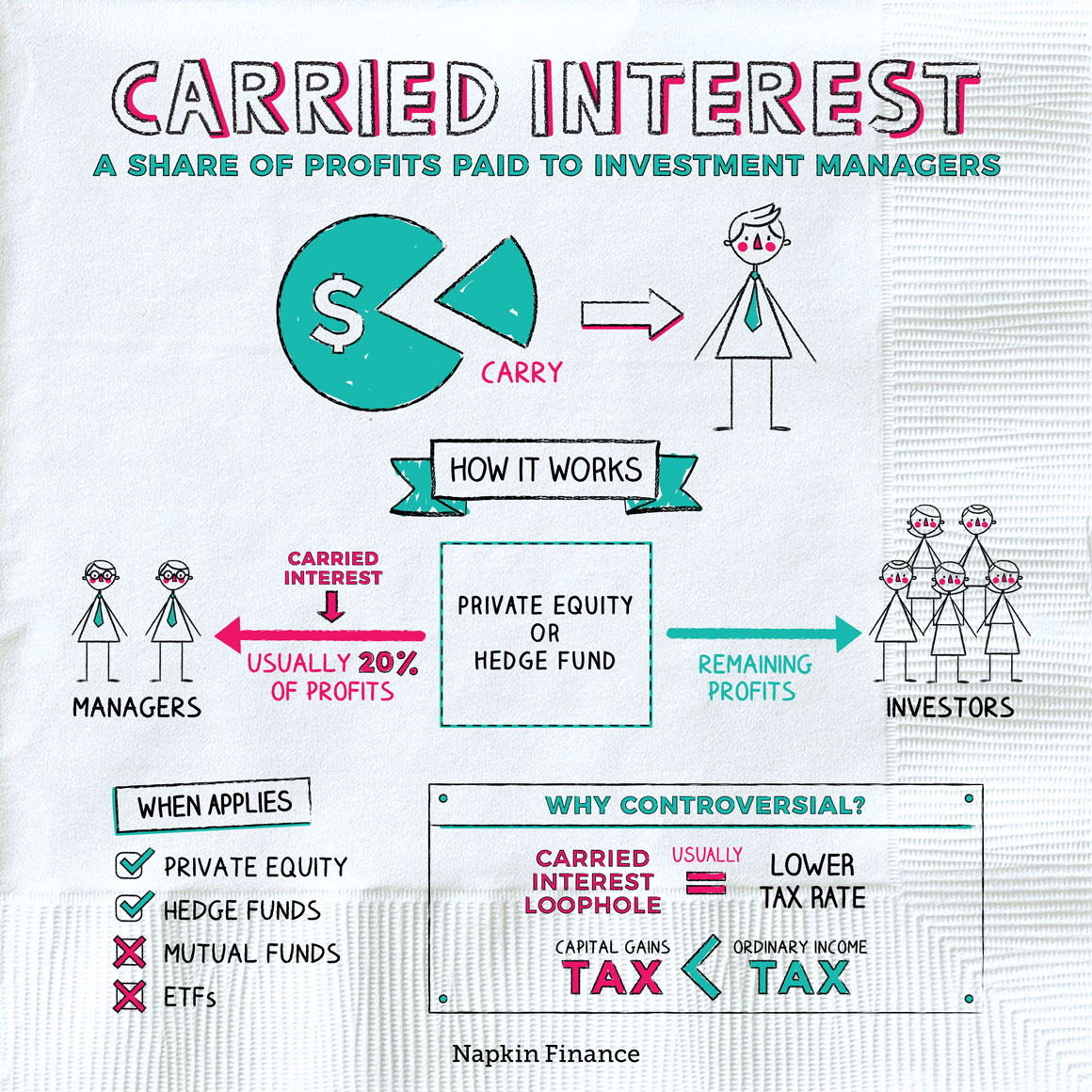

NEW MINIMUM TAX ON BIG BIZ. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends.

. At most private equity firms and hedge funds the share of. Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and salary income for the. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses.

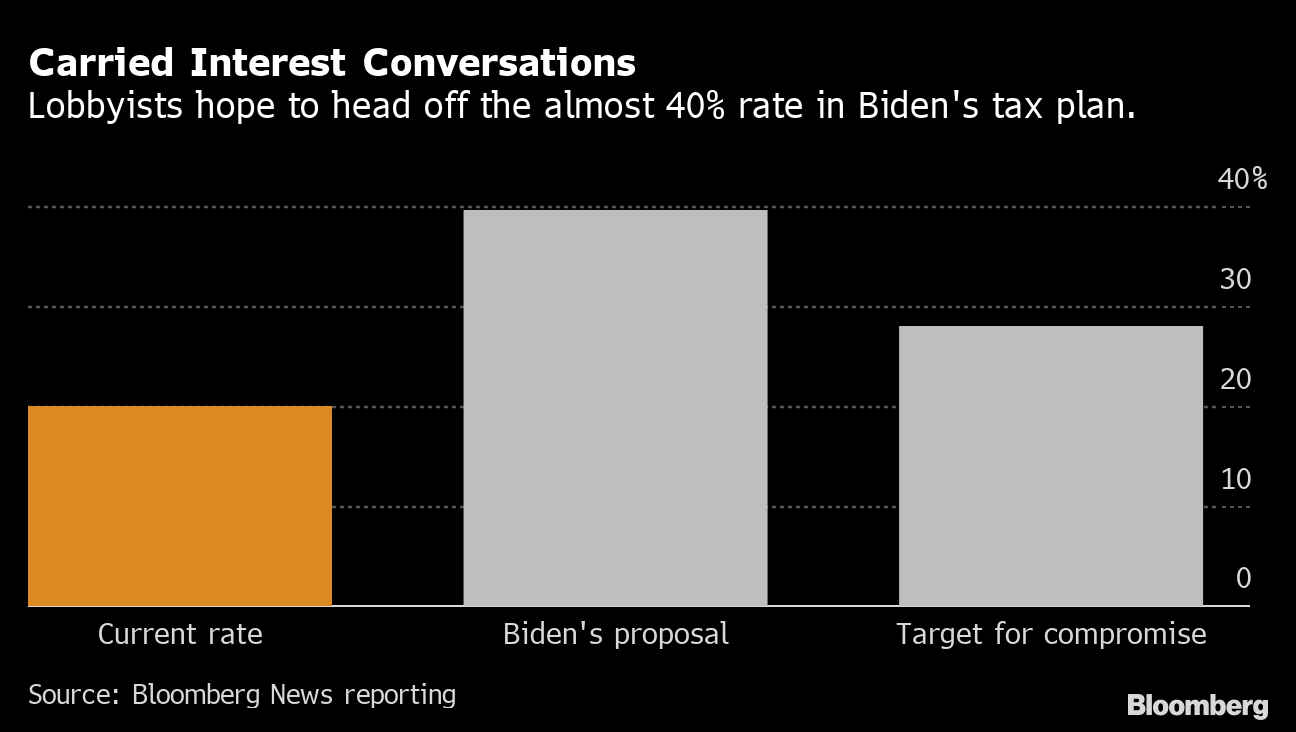

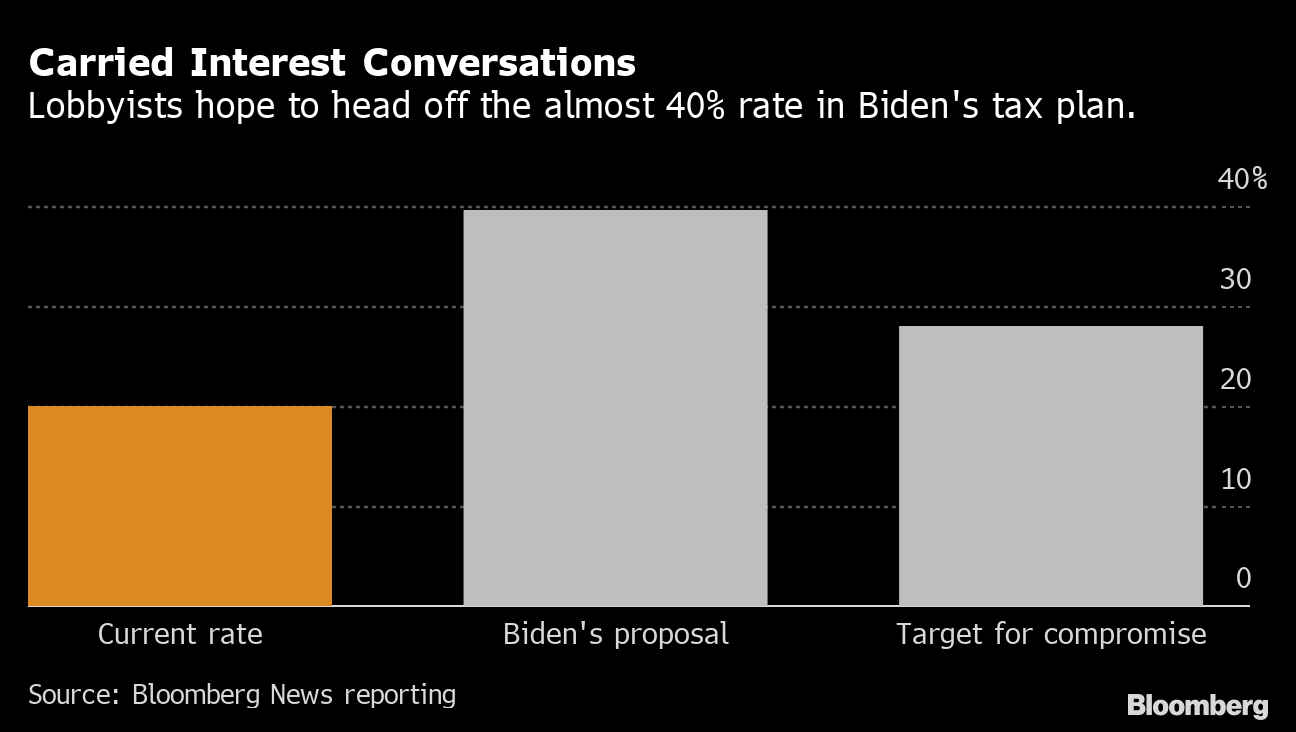

But these partners pay the individual capital gains rate when the other partners receive capital gains for sales of such assets as stock and real estate. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White House economist. The proposal would create a new 15 percent minimum tax on big corporations.

The matter has been adjourned for now. Potential Negative Impact to the Charitable Sector The July 27 draft of the Inflation Reduction Act IRA includes a provision from the September 2021 Ways Means Committee draft of Build Back Better Act BBBA that modifies how carried interest is treated under the tax code. This is called the carried interest The individual with the carried interest is taxed at the rates of ordinary income for his or her salary and for much of the business activities.

Carried Interest Tax Proposal. Carried Interest Tax Proposal Threatens Charitable Giving Elizabeth McGuigan Sector Regulation October 28 2021 Last month the House Ways and Means Committee marked up the Build Back Better Act to include a provision modifying how carried interest is treated under the tax code. The lawmakers provided this example.

The Democrats latest plan to hike taxes on carried interest a form of income earned by private equity funds that is subject to a lower tax. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades or businesses and.

Present law The Tax Cuts and Jobs Act added Section 1061 to the Internal Revenue Code effective for taxable years beginning after December 31 2017. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax.

The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric vehicle tax credits and. The top individual rate would be 396. The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022.

The proposal to single out carried interest as the sole tax increase on high earners is rooted in Democrats longstanding disdain for a tax preference that lets fund managers pay much lower capital. The proposals would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free.

Since these fees are generally not taxed as normal income some believe that the structure unfairly takes advantage. Carried interest or carry in finance is a share of the profits of an investment paid to the investment manager specifically in alternative investments private equity and hedge fundsIt is a performance fee rewarding the manager for enhancing performance. The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary.

At most private equity firms and hedge funds the share of. Details are still sketchy but its aimed at companies that report big profits to Wall Street.

Partnership Agreement Template Real Estate Forms Agreement Sales Template Templates

Fund Managers Thoughts On The Carried Interest Tax Loophole

Template Net Impact Assessment Template 6 Free Word Pdf Documents Download 6e06b212 Resumesample Resumefor Word Template Assessment Templates

Office Sample Budget Proposal Office Budget Template Making Own Office Budget Template I Event Proposal Template Event Proposal Business Plan Template Word

Results Of The Basic Income Experiment In Finland Small Employment Effects Better Perceived Economic Security And Me Income Mental Wellbeing Economic Research

How Does Carried Interest Work Napkin Finance

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Format Of Partnership Deed As Per Income Tax Act Partnership Deed Taxact Income Tax Partnership

Simple Room Rental Agreement Real Estate Forms Room Rental Agreement Contract Template Real Estate Forms

Partnership Agreement Template Real Estate Forms Contract Template Real Estate Forms Business Proposal Sample

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Employee Benefits Summary Template Employee Benefit Health Savings Account Templates

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Loophole For Real Estate Saved Again

Sponsorship Levels Sponsorship Sponsorship Package